Founded in 1980, Caldwell Financial Ltd. (CFL), a majority employee-owned firm, provides independent, personalized and innovative wealth management strategies, investment solutions and insurance products for families, individuals, corporations, trusts and foundations, as well as professional investment management for select institutional investors through its subsidiaries Caldwell Investment Management Ltd. (CIM), Caldwell Securities Ltd. (CSL) and Caldwell Insurance Services Ltd.

Investment Solutions

CSL, established in 1980 with offices in the Greater Toronto Area and southern Ontario, provides personalized, customized and sophisticated investment advice. Combining a value-driven, research-backed approach to investing, CSL offers active risk management and a commitment to superior client service and transparency.

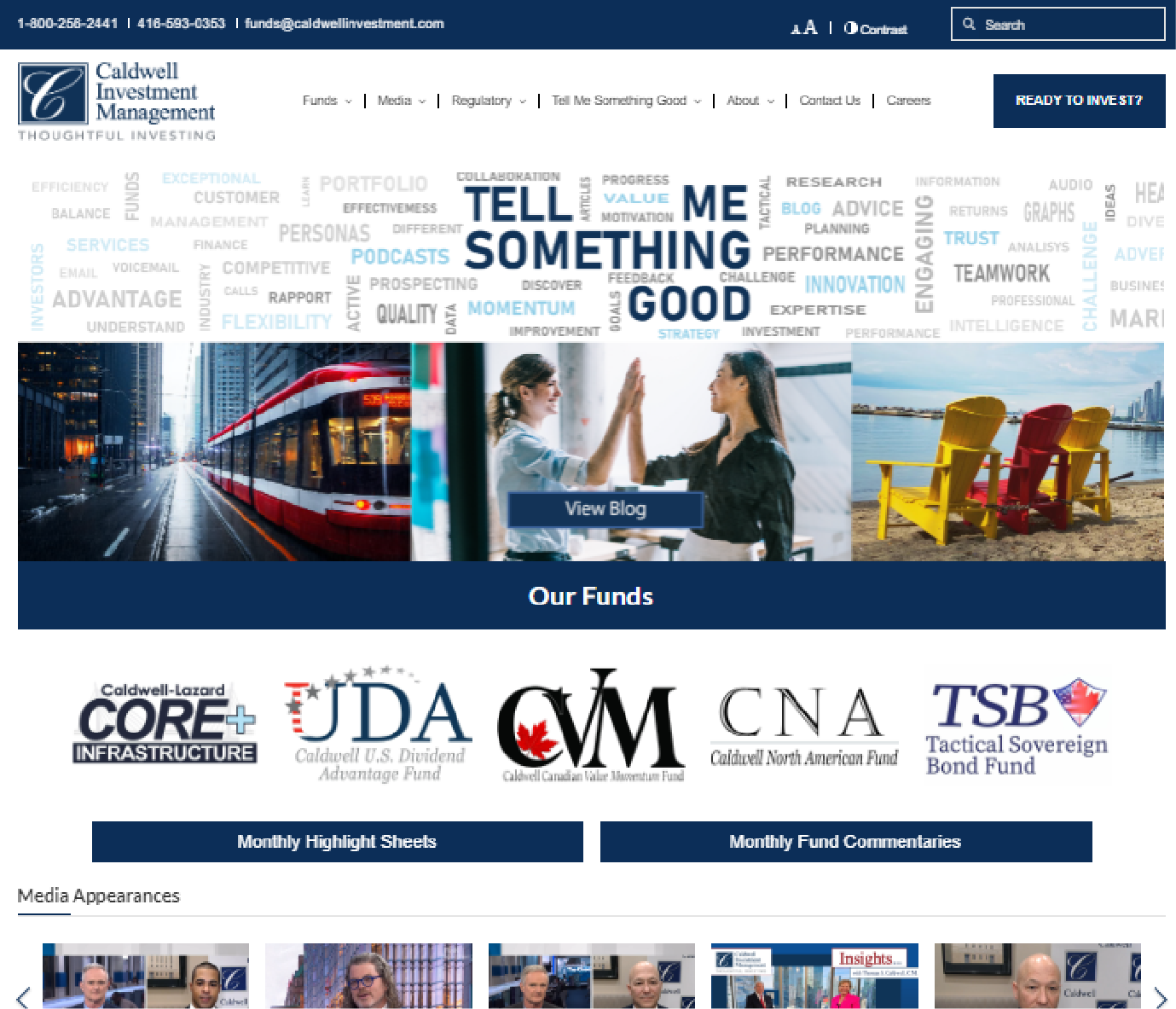

CIM, established in 1990 and located in Toronto, provides discretionary investment management and asset allocation services, investment advisory services and originates collective investment vehicles, to Canadian and international retail and institutional investors. CIM also offers a collection of investment fund solutions to help investors meet their investment goals.

CIS provides a collection of products and services to assist you in planning for the unexpected and to create a more secure future for individuals and businesses. CIM also offers personalized travel insurance to help protect you from the costs associated with unexpected emergencies and events.

Advantage: Confidence

We believe your most important investment management decision is choosing investment managers who put you first. We don’t just ask for your trust, we earn it by putting more than 30 years of experience and innovation to work on meeting your investment goals. We strive to achieve peace-of-mind for our clients and to foster relationships built on transparency.

Thomas S. Caldwell applies this basic set of investing principles gained during his more than 55 years of experience from his earliest days as an advisor with some of the best known Canadian investment firms and bank investment departments. He suggests that investors may find them useful when considering their investment plans, objectives, and processes:

- Investing is a marathon, not a 100-yard dash.

- Time in the market is more important than market timing.

- Quell emotions prior to making investment decisions.

- Challenging economic times can lead to profitable investing opportunities.

- Invest only in proven quality.

- Never borrow to invest.

- Invest steadily and regularly over time, using disciplined processes.